A small number of pharmacy benefit managers dominated the Medicare Part D, Medicaid and commercial markets in 2023, and the three biggest PBMs may each be targeting different payer markets, according to new USC Schaeffer Center research published Sept. 10 in JAMA.

Lawmakers and federal regulators are scrutinizing whether the PBM market’s high concentration is driving up drug costs and contributing to pharmacy closures. Three PBMs account for 80% of prescriptions in the United States, but limited information exists about how PBM concentration varies across payer types.

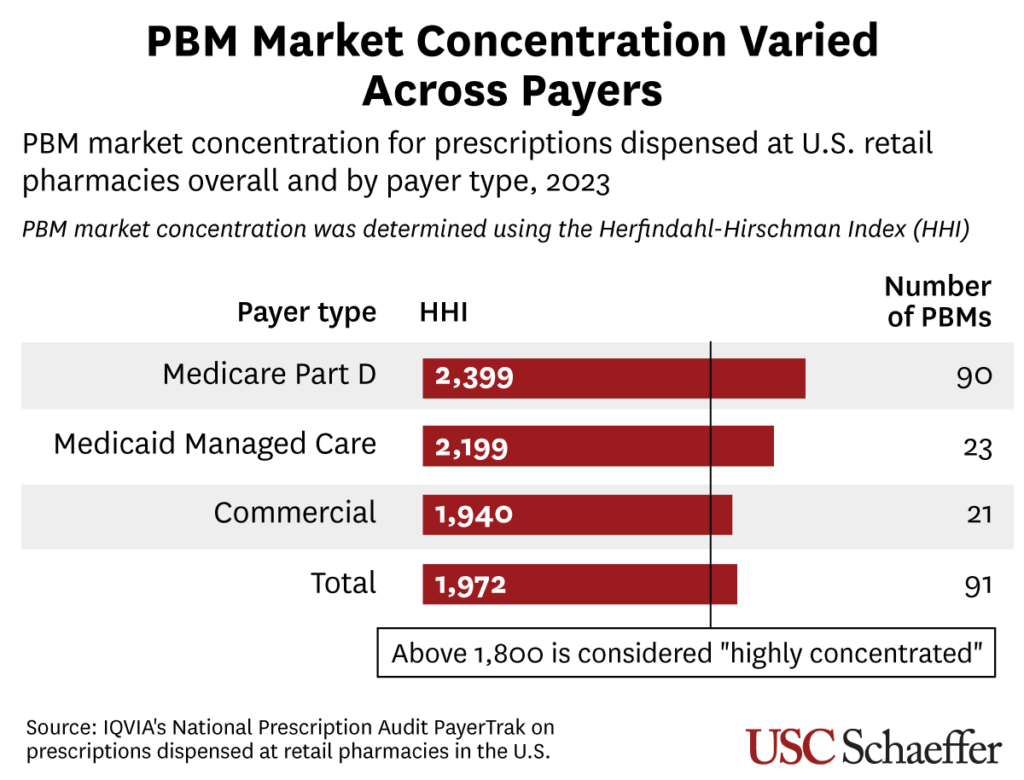

Key findings: All three payer markets exceeded a U.S. Department of Justice threshold for “highly concentrated” based on the commonly used Herfindahl-Hirschman Index. The Part D market had the highest level of concentration, while commercial insurance had the lowest.

- Among PBMs, CVS/Caremark was the dominant player in all three payer markets, while its largest market share was in Medicaid managed care (39.2% of PBM services).

- Express Scripts accounted for 28% of the commercial market, about double its shares of the Part D and Medicaid markets. Optum’s largest share was in Part D (27.7%).

- The five largest PBMs control 93.6% of the Part D market – much higher than their combined share of the commercial market (79.6%) and the Medicaid managed care market (71.5%).

- The findings are based on data from 90% of prescriptions filled at U.S. retail pharmacies in 2023.

Why it matters: “These findings underscore the importance of considering payer-specific concentration when evaluating PBMs’ anti-competitive practices, as the 3 top PBMs may be pursuing different market strategies,” researchers Dima Qato, Yugen Chen and Karen Van Nuys write in JAMA. The findings could inform proposed legislation aimed at reforming PBM practices and the Federal Trade Commission’s ongoing investigation into PBMs, they write.